The Single Strategy To Use For Financial Advisor Victoria Bc

Wiki Article

What Does Independent Financial Advisor Canada Mean?

Table of ContentsThe Ultimate Guide To Tax Planning CanadaAll About Investment ConsultantUnknown Facts About Independent Investment Advisor CanadaThe smart Trick of Independent Financial Advisor Canada That Nobody is DiscussingThe Ultimate Guide To Independent Investment Advisor CanadaSome Known Questions About Retirement Planning Canada.

.jpg)

Heath normally an advice-only planner, which means he does not control his consumers’ money right, nor does he offer all of them specific financial loans. Heath says the benefit of this process to him usually the guy does not feel bound to offer a certain item to fix a client’s cash problems. If an advisor is only prepared to offer an insurance-based cure for problems, they might end up steering some one down an unproductive road when you look at the name of hitting income quotas, according to him.“Most economic services people in Canada, because they’re paid in line with the services and products they have market, they may be able have motivations to recommend one strategy over another,” he states.“I’ve picked this program of activity because i will take a look my consumers to them rather than feel like I’m taking advantage of them in any way or attempting to make a sales pitch.” Tale continues below ad FCAC notes how you pay your own consultant depends upon this service membership they give.

The Definitive Guide for Independent Financial Advisor Canada

Heath along with his ilk are paid on a fee-only design, consequently they’re settled like a lawyer could be on a session-by-session basis or a per hour assessment price (investment consultant). According to range of services and expertise or typical clientele of one's expert or coordinator, hourly costs can range when you look at the hundreds or thousands, Heath statesThis is up to $250,000 and above, according to him, which boxes on many Canadian families using this degree of service. Story continues below advertisement for anyone unable to pay charges for advice-based strategies, and for those not willing to stop a portion regarding expense returns or without sufficient cash to get started with an advisor, there are a few less expensive as well as free of charge alternatives to consider.

The smart Trick of Lighthouse Wealth Management That Nobody is Talking About

Story continues below ad discovering the right financial planner is a bit like matchmaking, Heath claims: you wish to get a hold of some body who’s reliable, has actually an individuality match and is the right person the level of life you’re in (https://dribbble.com/lighthousewm/about). Some favor their unique experts as more mature with a little more experience, according to him, while some favor somebody younger who can hopefully stick with them from early decades through retirement

The Facts About Lighthouse Wealth Management Revealed

One of the greatest blunders somebody makes in selecting a specialist is not asking enough questions, Heath states. He’s astonished as he hears from customers that they’re nervous about asking questions and probably being stupid a trend he discovers go to this website is equally as common with set up experts and the elderly.“I’m surprised, as it’s their funds and they’re spending lots of charges to these people,” he states.“You deserve for the questions you have answered while deserve having an unbarred and truthful commitment.” 6:11 economic planning all Heath’s last advice applies whether you’re searching for outside economic assistance or you’re heading it by yourself: keep yourself well-informed.Listed below are four points to consider and have your self when determining whether you need to tap the expertise of a monetary consultant. Your internet well worth just isn't your income, but instead a quantity that will help you understand exactly what cash you earn, exactly how much it can save you, and for which you spend some money, also.

Get This Report about Lighthouse Wealth Management

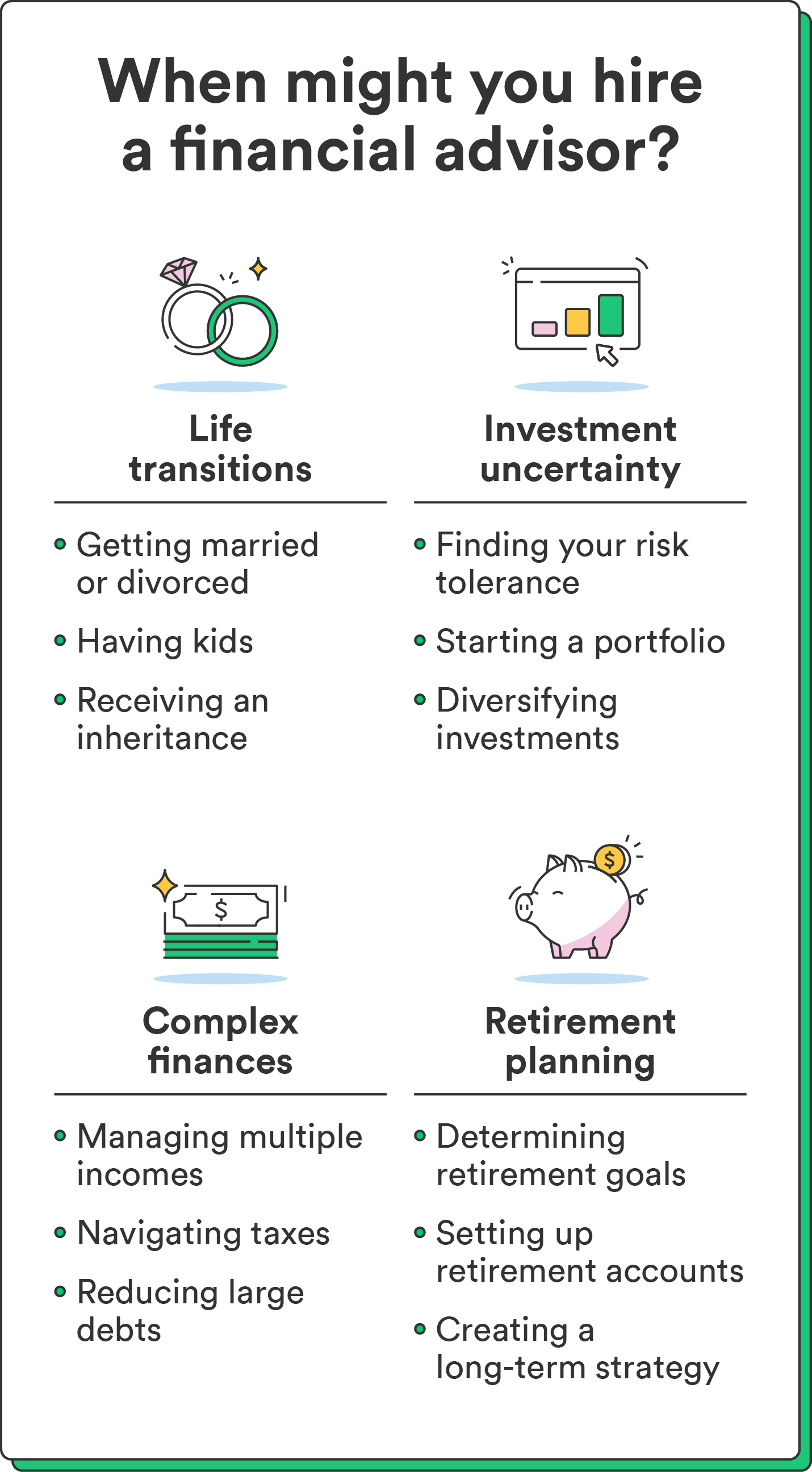

Your infant is on how. Your own separation and divorce is actually pending. You’re nearing your retirement. These along with other major life activities may prompt the necessity to go to with a financial expert regarding the investments, debt goals, along with other financial matters. Let’s state the mother kept you a tidy sum of money within her will.

You could have sketched out your own economic strategy, but have a tough time staying with it. A financial expert may offer the responsibility you'll want to put your financial anticipate track. Additionally they may advise just how to tweak your own monetary plan - https://www.quora.com/profile/Carlos-Pryce-1 being maximize the possibility effects

All About Tax Planning Canada

Anybody can say they’re an economic expert, but an advisor with pro designations is if at all possible the one you really need to hire. In 2021, approximately 330,300 Americans worked as personal economic analysts, according to the U.S. Bureau of Labor studies (BLS). Many financial experts tend to be self-employed, the agency says - independent investment advisor canada. Typically, you'll find five forms of monetary experts

Brokers generally make income on trades they generate. Brokers tend to be regulated by U.S. Securities and Exchange Commission (SEC), the economic field Regulatory Authority (FINRA) and state securities regulators. A registered expense specialist, either one or a company, is a lot like a registered representative. Both trade opportunities on the behalf of their clients.

Report this wiki page